Books are the next category to tackle in the KonMari method.

Books

This category surprised me. If you asked me how many fiction books I owned, I would say around 10, and I would be correct. I strongly believe in the public library system, so I rarely buy books. The ones that I do own are ones that I have read more than once: Hitchhiker's Guide to the Galaxy, the novels of Jane Austen, To Kill a Mockingbird, The Devil in the White City, Perfume, Auntie Mame, etc.

However, when it comes to my nonfiction and instructional books, the number shocked me. Now, I knew that I owned A LOT of sewing books, more than twenty-five. Also, several books on historical fashion, fashion designers, Hollywood costume design, and one book on "female etiquette and charm" from the 1960s. Whoa.

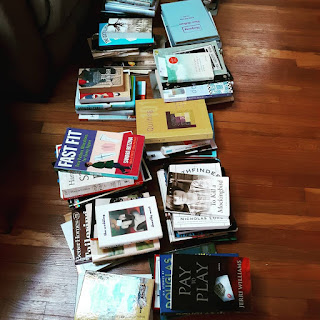

But I had also held onto old art and historical preservation textbooks, books I had received in exchange for book reviews on my blogs, and of course, any books given as gifts. There were so many books! It never occurred to me how many I had because they were in several places; some had been in storage since I moved six years ago. As Marie says in her book, it IS crucial to see what you own to keep track of it.

Well, I was able to get rid of quite a few of them:

- The fiction books that I would not be reading again.

- Woefully outdated job search books.

- Fussy cookbooks that I never used.

- Self-help books that others had given me to be "helpful."

I also kept three books that I will offer to specific friends I think might like them.

Moving on to Category three, it was time to gather all the paper documents I had around the house.

Papers

Wow, this category for me was immense. I believe in paper ephemera of all kinds! I also seem to love documenting occasions with facts and dated material. However, there were many things that I kept for far too long:

- Copies of filed tax documents. (I had my very first 1040EZ form from 1989!).

- Pay stubs from jobs going back to the 1990s.

- My essays and research papers from junior high and college.

- College class report cards.

- Performance reviews from all my past jobs!

- Old credit reports

- Checkbooks registers from 1998 till the present.

The big question is, why was I holding on to all this stuff, year after year? Even the IRS suggests keeping only seven years of documents for possible audits. However, I was keeping THIRTY years' worth!

I stashed a lot of documents in several mismatched containers; however, the three black file cases were my "official" repositories and held the rest:

- Product warranties, apartment leases, car insurance documents, auto maintenance, and health records

- All clippings about fashion, movies, home decor, and planning details from the weddings I helped plan, basically, my hard copy Pinterest. There were clippings in there from high school in the late 1980s.

|

| Check registers are OUT, and a handmade book I made in eighth grade is IN. |

|

| Much more space is available, and I kept the me-made book. |

Marie's belief on paper is to Discard Everything! After my shredding chronicles, I may agree. As she said, short of personal cards and letters, you should discard most paper documents. I agree that you can remove most financial papers after a year. When it comes to taxes, those medical receipts you added up for health expenses can go in the trash the second you add that total to your taxes.

|

| View of all the paper found in my house. |

Last but not least is a picture of how I stored all the paper in my house. These multiple types of storage boxes held various documents, articles, college admission and loan paperwork, financial records, examples of event and conference materials from old jobs, correspondence, greeting cards, and loose photographs. I now have these pared down to the three portable file boxes, the fireproof safe, two dedicated boxes for photos, stationery, and another one for personal letters and cards (which I will deal with in the last category, Sentimental Items.)

You are doing an amazing job with this. Keeping the paper tiger under control is so hard. But, don’t you need to keep those receipts related to your tax deductions, in case of an audit? At least for 7 years, I understand.

ReplyDeleteDid you go through all your old photos, too? I have tons including some I inherited from my mom. That would be the hardest thing to cull, for me..

Good luck with your endeavors.